I have skipped it lots of times, and my number has yet to come up. If it ends up that I need to cancel or interrupt, I'll simply have to take my monetary swellings I played the odds and lost. However in many cases it's probably a great idea to get this coverage for instance, if you're paying a great deal of up-front money for an arranged tour or short-term lodging rental (both of which are expensive to cancel), if you or your travel partner have questionable health, or if you have an enjoyed one in the house in bad health. A basic trip-cancellation or disturbance insurance coverage covers the nonrefundable monetary penalties or losses you sustain when you cancel a pre-paid tour or flight for an acceptable reason, such as: You, your travel partner, or a member of the family can not take a trip due to the fact that of sickness, death, or layoff, Your tour business or airline fails or can't carry out as promised A relative in the house gets ill (check the small print to see how a member of the family's pre-existing condition might affect protection) You miss out on a flight or require an emergency flight for a reason outside your control (such as a cars and truck accident, severe weather, or a strike) So, if you or your travel partner unintentionally breaks a leg a couple of days before your journey, you can both bail out (if you both have this insurance) without losing all the cash you spent for the trip.

This type of insurance can be used whether you're on an organized tour or cruise, or traveling independently (in which case, just the prepaid expenses such as your flight and any nonrefundable hotel bookings are covered). Keep in mind the distinction: Journey cancellation is when you do not go on your journey at all. Trip disruption is when you start a journey but have to suffice brief; in this case, you'll be repaid only for the portion of the journey that you didn't total. If you're taking a tour, it may already feature some cancellation insurance ask - How much is home insurance. Some insurance providers will not cover particular airline companies or trip operators.

Make certain your provider is covered. Buy your insurance plan within a week of the date you make the first payment on your trip. Policies purchased later on than a designated cutoff date generally 7 to 21 days, as figured out by the insurance provider are less most likely to cover tour business or air provider insolvencies, pre-existing medical conditions (yours or those of relative in your home), or terrorist occurrences. Mental-health issues are normally not covered. Jittery tourists are fretful about 2 huge unknowns: terrorist attacks and natural catastrophes. Ask your business for details. A terrorist attack or natural catastrophe in your home town may or might not be covered.

Even then, if your tour operator offers a replacement travel plan, your coverage may end up being void. When it comes to natural catastrophes, you're covered just if your destination is uninhabitable (for example, your hotel is flooded or the airport is gone). War or outbreaks of illness normally aren't covered. With travel turned upside down by the coronavirus pandemic, it's more important than ever to understand what travel insurance coverage covers and what it doesn't. While a lot of standard policies supply coverage for flight cancellations and trip disruptions due to unpredicted events, the majority of COVID-19related concerns are left out from protection, including: Fear of travel: If you choose not to take a trip out of worry of contracting COVID-19, your insurance coverage won't cover you.

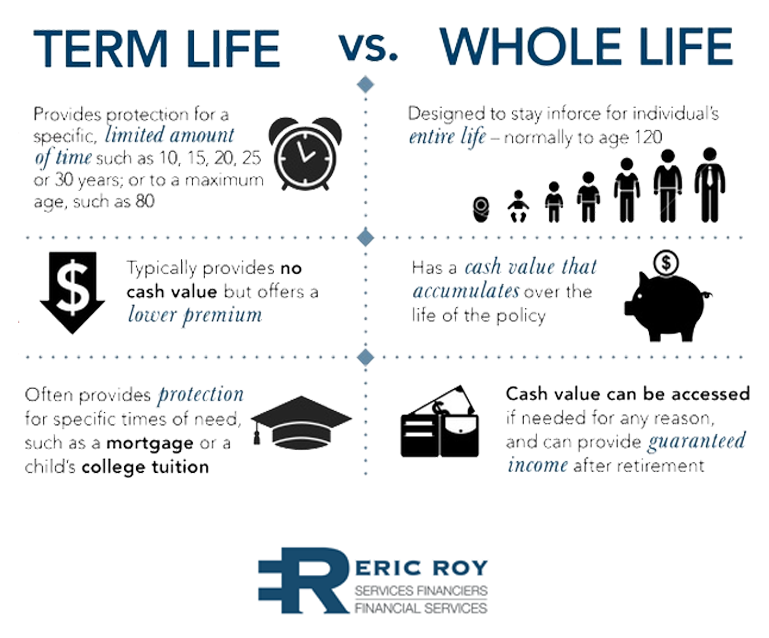

Excitement About What Is Term Life Insurance

Extra COVID-19 outbreaks: If the area you're planning to check out experiences brand-new shutdowns after you have actually scheduled the trip, don't want to your travel insurance for coverage. Breaking federal government travel warnings: If you do have protection, your policy may be voided if you travel someplace that your federal government has actually considered risky, or if your federal government has limited worldwide travel. You may have the ability to prevent the concern of what is and what isn't covered by purchasing a costly "cancel for any factor" policy (described listed below). Health emergency situations are the main cause for journey cancellations and interruptions, and they can feature high medical costs along with extended lodging costs for travel partners.

While many United States insurance providers cover you overseas, Medicare does not. Likewise, be sure you're aware of any policy exemptions such as preauthorization requirements. Even if your health insurance does cover you globally, you may desire to consider purchasing an unique medical travel policy. Much of the extra protection readily available is supplemental (or "secondary"), so it covers whatever costs your health insurance does not, such as deductibles. However you can likewise acquire main protection, which will look after your expenses as much as a certain amount. In emergency situation circumstances involving expensive procedures or overnight stays, the medical facility will usually work straight with your travel-insurance carrier on billing (but not with your regular health insurance business; you'll likely have to pay up front to the medical facility or clinic, then get repaid by your stateside insurance provider later on).

Whatever the situations, it's clever to call your insurance provider from the roadway to let them understand that you have actually looked for medical help. Lots of pre-existing conditions are covered by medical and trip-cancellation protection, depending upon when you purchase the protection and how recently you've been treated for the condition. If you travel often to Europe, multi-trip yearly policies can conserve you cash. Contact your representative or insurer prior to you devote. The US State Department periodically issues cautions about traveling to at-risk nations. If you're visiting among these nations, your cancellation and medical insurance coverage will likely not be honored, unless you purchase extra protection.

Compare the expense of a stand-alone travel medical plan with extensive insurance, which comes with great medical and evacuation coverage. A travel-insurance business can help you sort out the options. Certain Medigap strategies cover some emergency situation care outside the US; call the provider of your extra policy for the details. Theft is specifically uneasy when you consider the dollar worth of the products we pack along. Laptops, tablets, cams, mobile phones, and e-book readers are all pricey to replace. One way to secure your investment is to purchase travel insurance from a specialized business such as Travel Guard, which provides a variety of alternatives that include coverage for theft.

What Does What Is Travel Insurance Do?

It's also smart to talk to your house owners or renters insurer. Under many policies, your personal property is currently secured versus theft anywhere in the world however your insurance coverage deductible still applies. If you have a $1,000 deductible and your $700 tablet is taken, you'll have to pay to change it. Rather than purchasing different insurance, it may make more sense to add a rider to your existing policy to cover pricey items while you take a trip. Prior to you leave, it's a great concept to take an inventory of all the high-value items you're bringing. Make a list of identification numbers, makes, and designs of your electronic devices, and take pictures that can act as records.